What is a credit score?

Financial institutions use certain measures to determine the creditworthiness of a consumer. Many of these numbers are based on a consumer's pay rate, debt to income ratio, and the ratio of the payment to total debt.

Ready...

A credit score determines if you will be approved for a loan. Additionally, a credit score determines what you pay for a loan in interest.

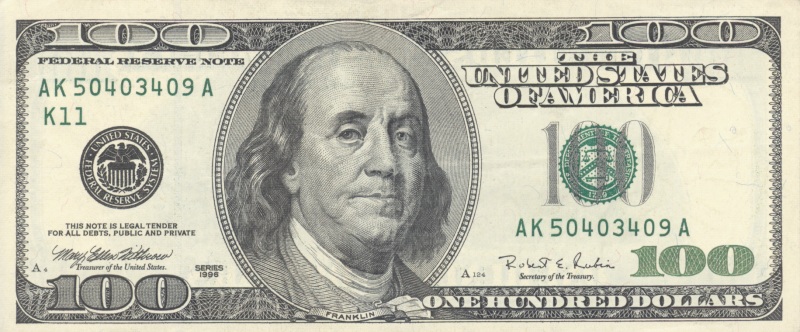

Why is a credit score so important? Will a low credit score cost you many Benjamins?

Review the lesson vocabulary before getting started.

We are exploring various ratios and rates and their effect on our financial condition.

A Debt to Income ratio represents the comparison of our monthly payments (expenses plus taxes) against the total amount of money we receive during a month (Gross Income).

We can write the Debt to Income ratio as either:

Debt:Income

Debt Income

Set...

Download the read along credit score quiz..

Read How Credit Scores Work.

Go...

Save the template to your work folder.

Complete and submit the quiz to your teacher.

Done Early?

Research the meaning of a currency rate of exchange?

Use a search engine to find an exchange calculator to find the rate of exchange for three currencies using $1, $5, and $10 US dollars.

Include the currency rates/ratios in the template that you are submitting to your instructor.